[elements]

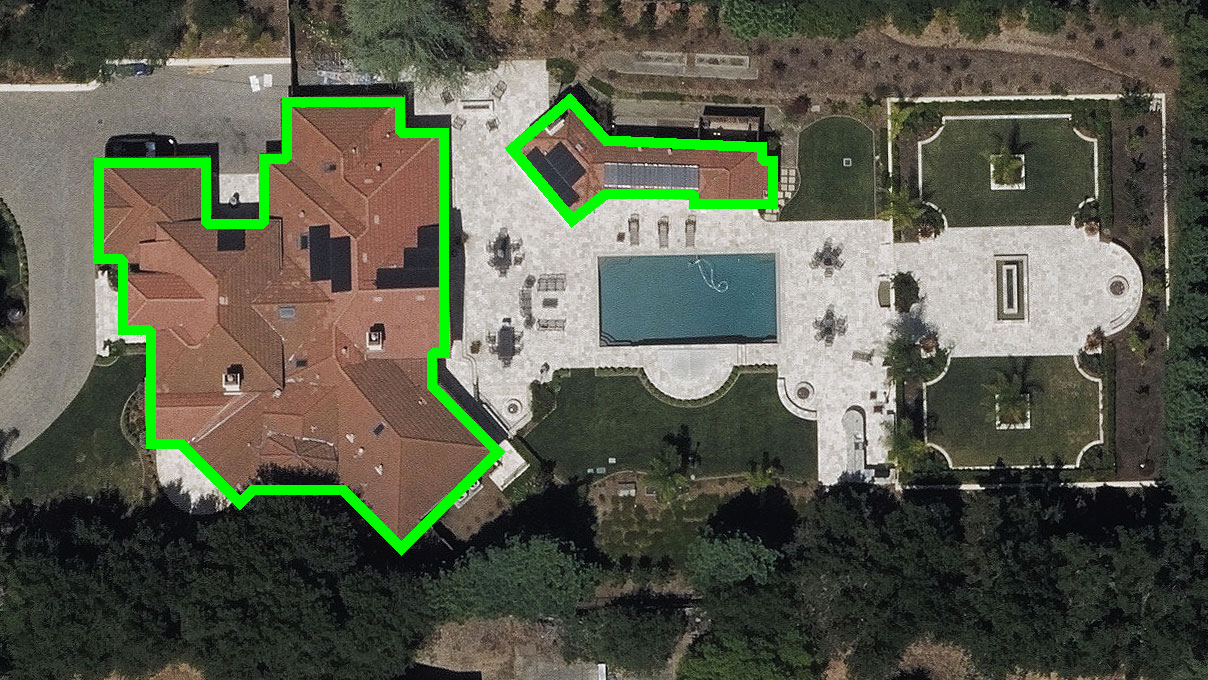

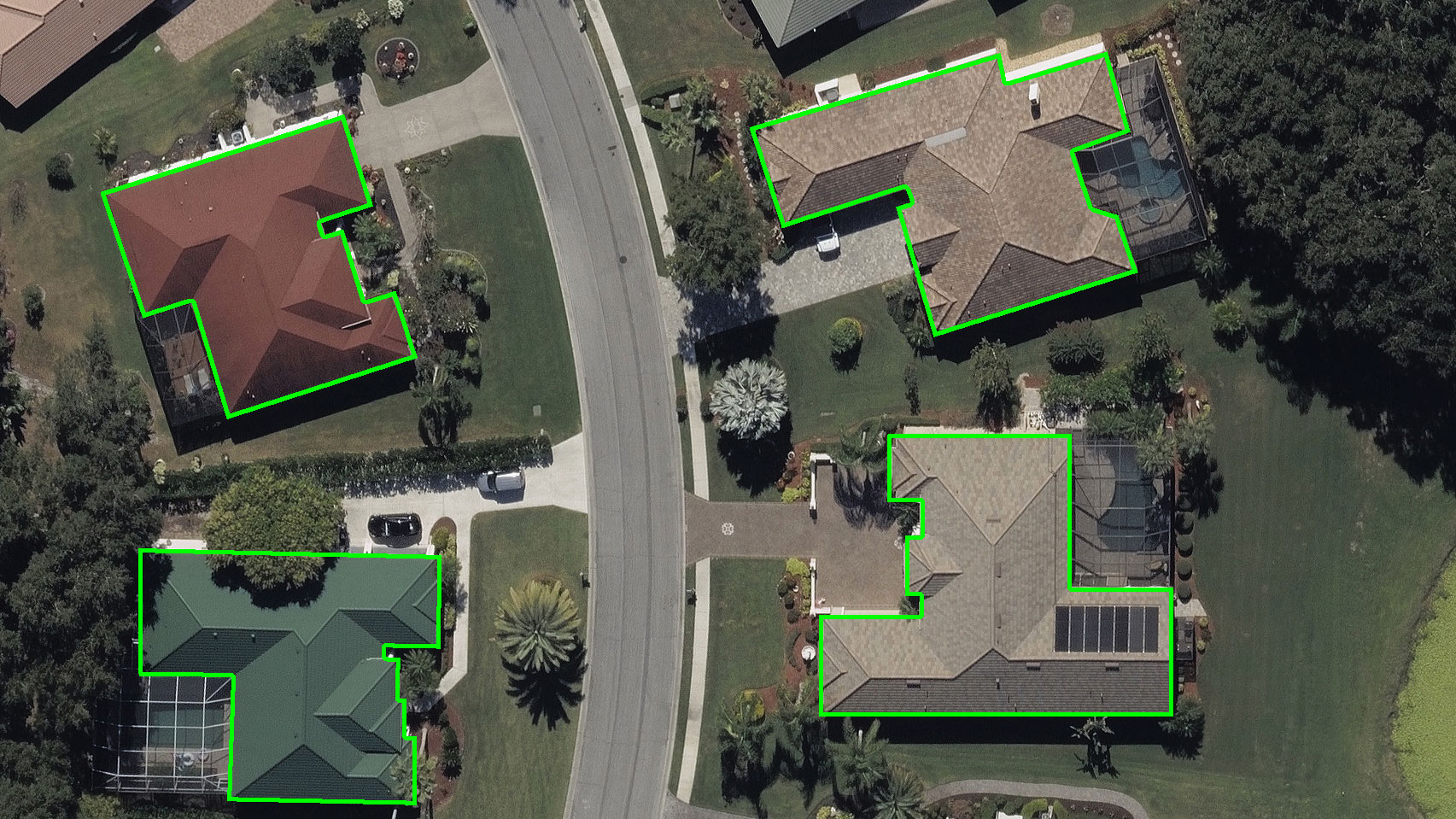

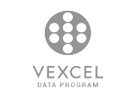

Building Footprints

Use trusted building geometry for your policies and risk models

Building Footprints in 25+ Countries

Get enhanced property visualization and evaluation through the use of building footprints, calculated on the GIC’s consistently reliable and highly accurate aerial imagery. View footprints across a big area (as a vector map layer) or at a specific location (by address or latitude/longitude).

Underwriting

- Validate placement of structures within a given parcel for underwriting

- Identify number of structures on an insured property

- Proactively track changes to a building

Risk Assessment

- Match building footprints to flood zones

- Use storm surge maps layered on building footprints to identify structures at risk

- Layer wildland maps with footprints to improve defensible space zones

Claims management

- Confirm a building’s exact location using footprint data

- Validate processed against footprint data to ensure proper use, fight fraud

Better Property Reviews Demand Better Data

Simplify your understanding of a building’s footprint using data calculated off of the GIC’s high-resolution aerial imagery. It’s a better way for property and casualty insurers to see in seconds what a building is shaped like, its dimensions, and how much space it takes up relative to its surroundings.

Consistency & Accuracy Across Products

Building Footprints data is derived from the GIC’s high-resolution aerial imagery and Digital Surface Model (DSM) data. The accuracy across product types from the GIC means this information is the same across multiple types of imagery, giving you confidence in the precision of building footprint calculation.

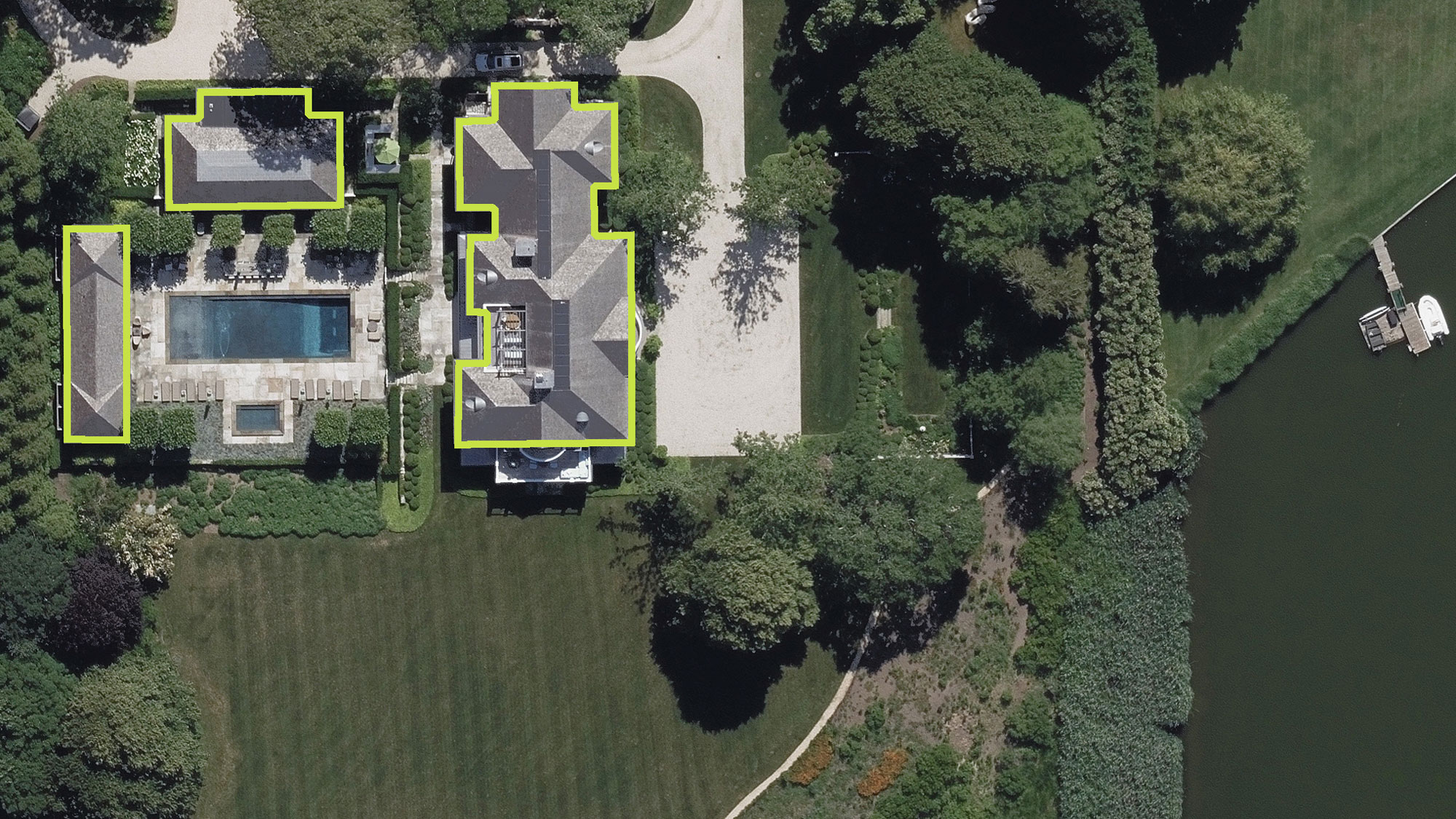

Compare and Contrast Footprint Changes

Multiple use cases abound with Building Footprints, especially when it comes to reviewing and evaluating properties for changes and additions. Access historical imagery and data with the GIC’s library to compare and contrast footprint changes to write a better policy or resolve a claim.

Request A Demo

Unlock more insights for insurance.