[elements]

Damage Assessment

Rapid property insights for post-CAT wind and fire disasters

Catastrophic Weather Trends Demand Powerful Property Analytics

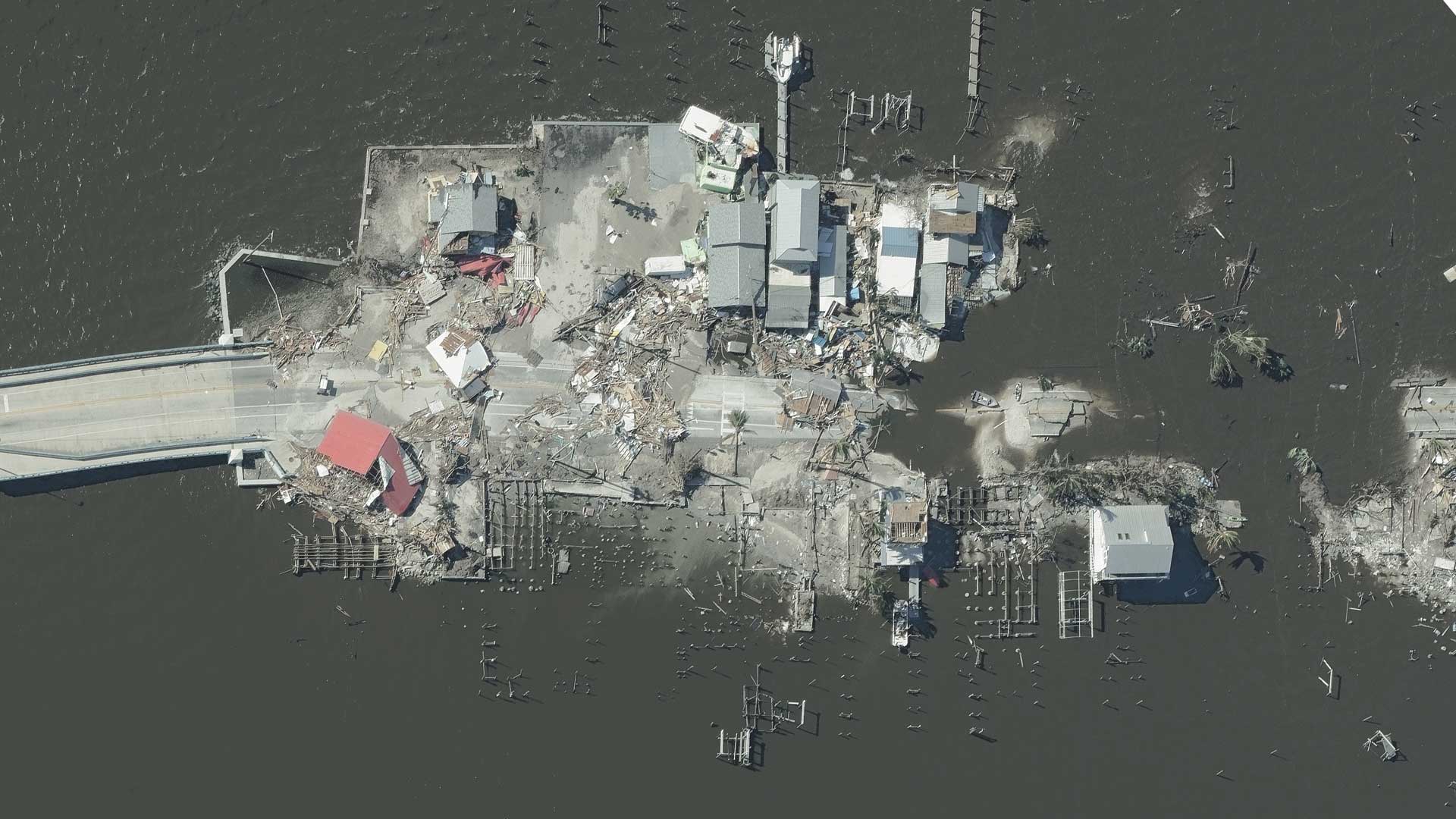

As destructive weather patterns grow globally, the need for rapid property insights becomes a necessity. Climate analysts have attributed rising global temperatures to the escalating spate of tornadoes, hurricanes, and wildfires. And with these disasters comes the inevitable aftermath of destruction and despair for communities needing to rebuild. This type of weather is also transforming the insurance landscape, creating new opportunities to employ technology and tools, such Damage Assessment, to aid in managing claims and risk for insurers big and small.

Use Damage Details to Proactively Help Impacted Customers

When catastrophic weather hits, our members are on high alert, anxiously awaiting the Gray Sky imagery we collect to match against their PIFs. By applying machine learning across the GIC’s high-resolution Gray Sky aerial imagery, automated insights can be delivered in seconds. Starting with location coordinates, members can pull damaged structures, highlight the customers in greatest need, then proactively reach out to those impacted to begin the claims process–all without ever needing to set a foot on the ground.

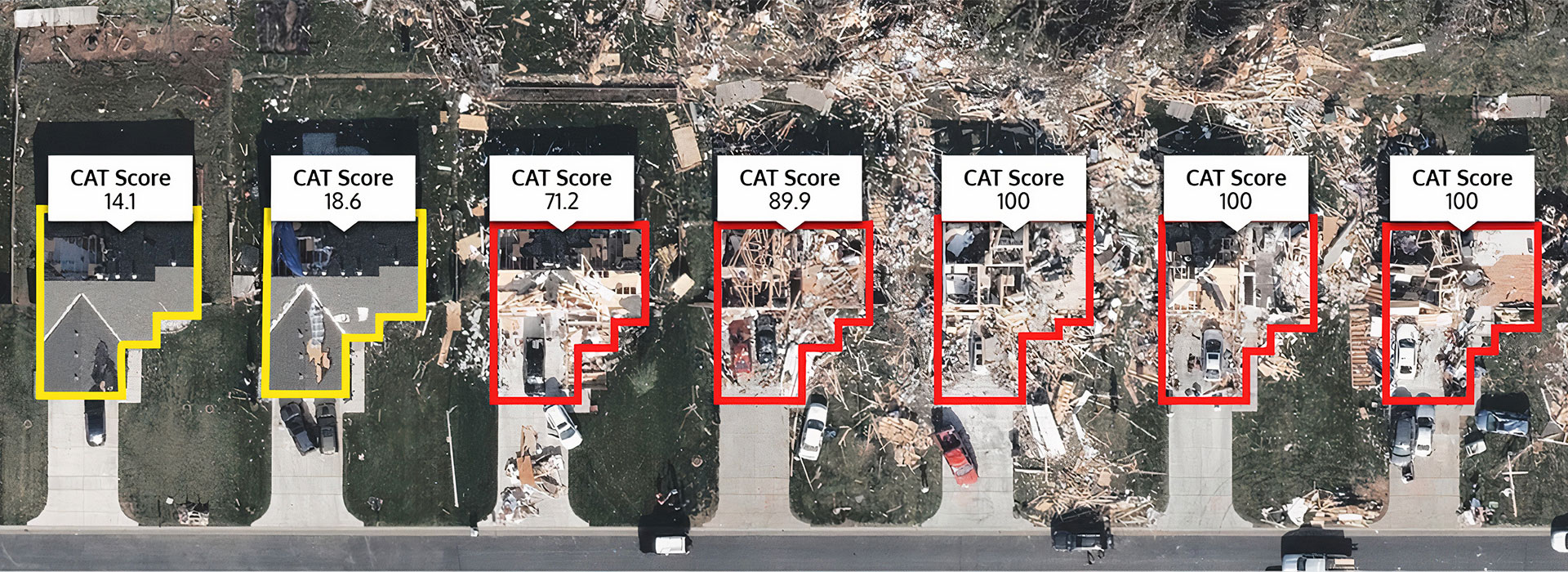

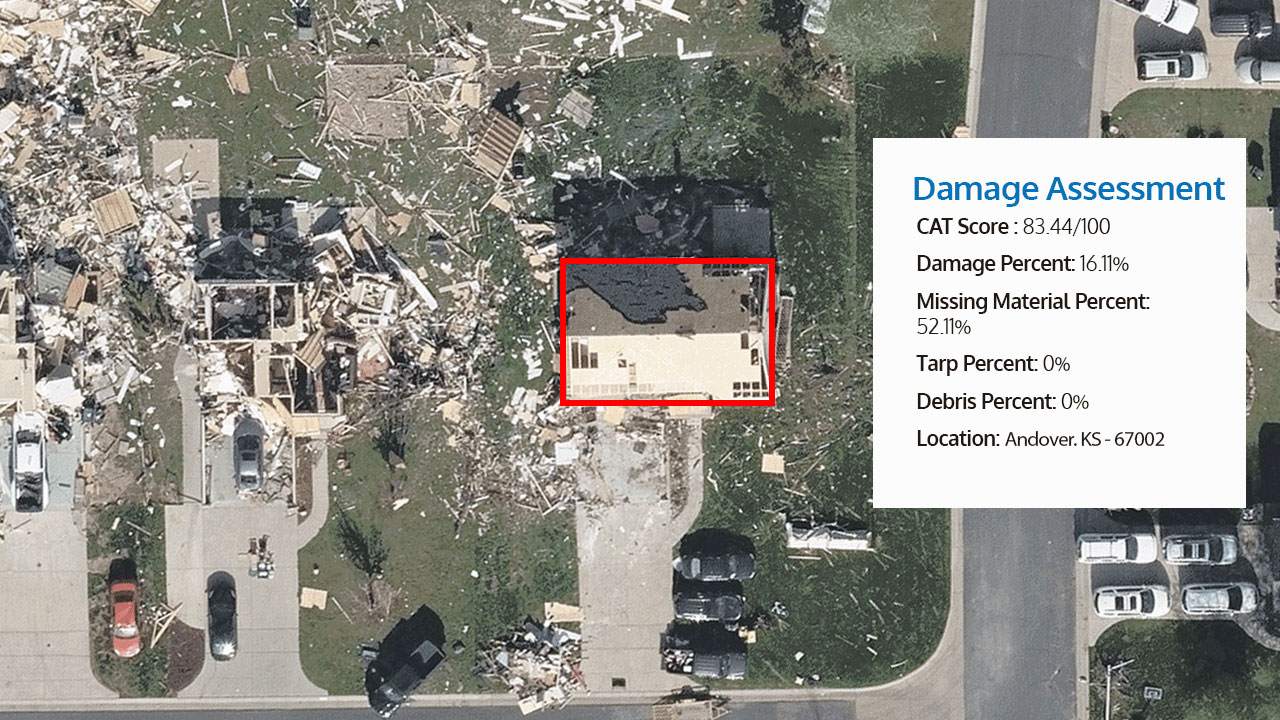

Post-CAT Property Awareness in Seconds

With Damage Assessment, multiple pieces of information on a damaged building can give members context to real truth on the ground. By accessing information beyond what’s discernible to the eye, members can quickly categorize the damage in multiple ways, from an overall CAT score to how much roof material is missing to debris coverage. These additional property insights can help members scale their responses with greater agility, verifying which policy holders have damaged property. This report will be available shortly after Gray Sky collection and will cover every property that falls within a natural disaster impacted zone.

Manage Resources, Shore Up Risk with Detailed Information

Access to these automatically calculated property analytics provides numerous benefits to GIC members. Using this data, members can:

- Better manage and scale responses to heavily impacted customers

- Proactively identify policy holders with damaged property and begin the claims process immediately

- Deploy resources, i.e, field adjusters, more effectively and safely with detailed information for remote assessment on damaged structures

- Pinpoint key learnings to shore up underwriting and risk policies for future events

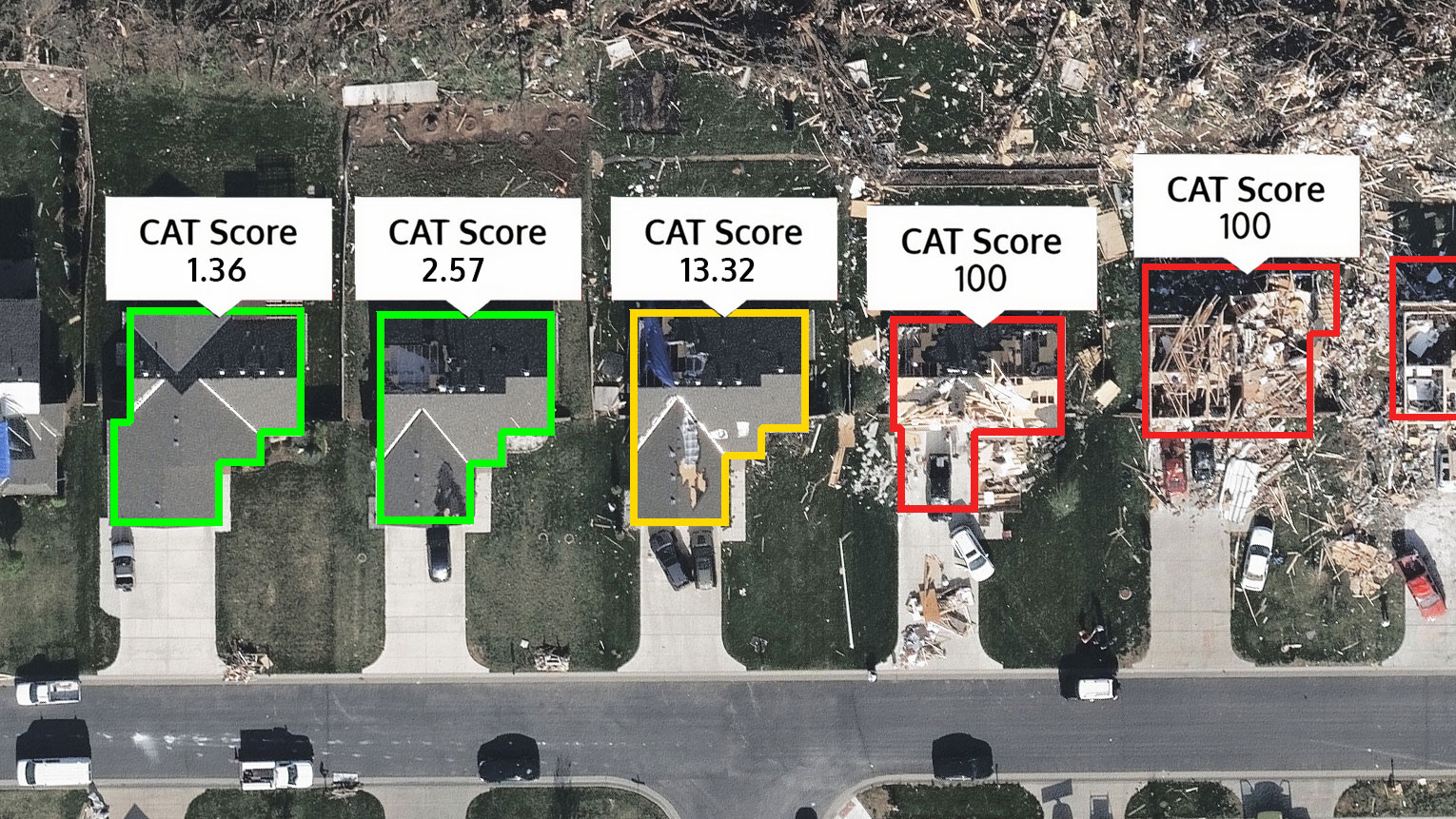

Compare Before and After Views

Historical imagery provides another layer of information members can use to validate changes and reduce uncertainty when processing a claim. By comparing the Damage Assessment report to the GIC’s Blue Sky imagery, members can quickly verify valid destruction on a property to triage and assess loss.

Attributes for Damage Assessment

Get building damage information quickly by using Damage Assessment on the GIC’s Gray Sky imagery. The product helps deliver automatically calculated data, helping streamline your PIF assessment by rating the damage a building sustained from a wind or fire event.

- Footprint polygon

- Footprint area

- Ground elevation

- ROOF FEATURES

- Roof condition

- Roof centroid location

- Roof material

- Roof shape

- Roof solar

- ROOF DISCOLORATION

- Algae staining

- Vent staining

- Water pooling

- ROOF ELEMENTS

- Tree cover over roof

- Air conditioning units

- Chimneys

- Roof vents

- Satellite dish

- Skylight

- DEFENSIBLE SPACE REPORT

- Trees: 5, 30, 100, 200 ft

- Buildings: 5, 30, 100, 200 ft

- PROPERTY FEATURES

- Primary structure

- Parcel geometry

- Playground

- Sports court

- Trampoline

- Enclosure

- Hardscapes: Detected

- Hardscapes: Area

- Deck: Detected

- Deck: Area

- Pool: Detected

- Pool: Type

- Pool: Surface Area

- Water slide

- Diving board

- Vehicles: Automobiles

- Vehicles: Boats

- Parcel tree cover

- DAMAGE CLASSIFICATION

- Damage footprint

- Catastrophe Score

- Approx. FEMA classification

- Roof structure damage

- Tarp covering roof

- Roof missing material

- Debris on roof

- Damaged roof discoloration

- Coverage: Damage Assessment

- Delivery methods: GIC Viewer, GIC APIs, Select GIC Partners, PDF Reports

Download A Damage Report

See detailed damage assessments derived from high-res aerial imagery, all packaged into a comprehensive PDF report.

Request A Demo

Unlock more insights for insurance.